Address

Floor 3, Building B, Honghua Science And Technology Innovation Park,

Longhua District, Shenzhen

Work Hours

Monday to Friday: 9AM - 9PM

Weekend: 10AM - 6PM

Address

Floor 3, Building B, Honghua Science And Technology Innovation Park,

Longhua District, Shenzhen

Work Hours

Monday to Friday: 9AM - 9PM

Weekend: 10AM - 6PM

Fueled by both public and private investment, North America has been the fastest growing region over the last two years for PON equipment used to deliver residential fiber broadband services. Total spending by service providers on PON equipment in the region has grown from $774M in 2019 to an expected $1.9B in 2022. Service providers of all sizes continue to expand on their initial goals of passing homes with fiber as they overbuild legacy DSL footprints while seeking to leapfrog cable operators which have dominated the broadband market in the region for years. Indeed in many cases, one of the primary reasons for the heavy focus on fiber was the dramatic loss of DSL subscribers to cable during 2020 and 2021, as subscribers’ bandwidth requirements easily exceeded what ADSL2+ and VDSL technologies could provide.

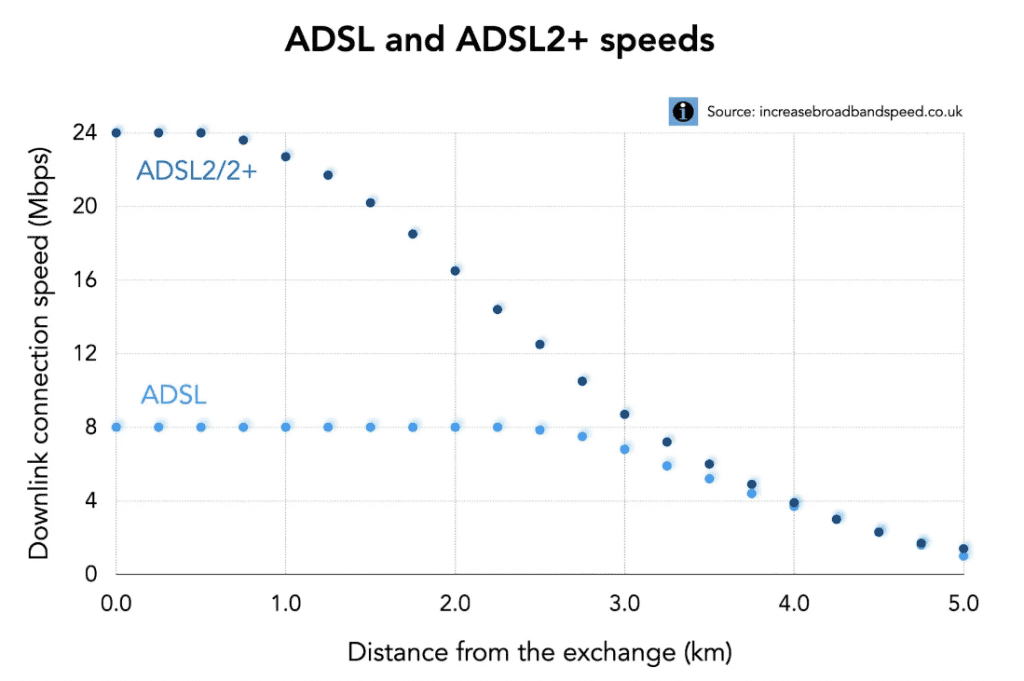

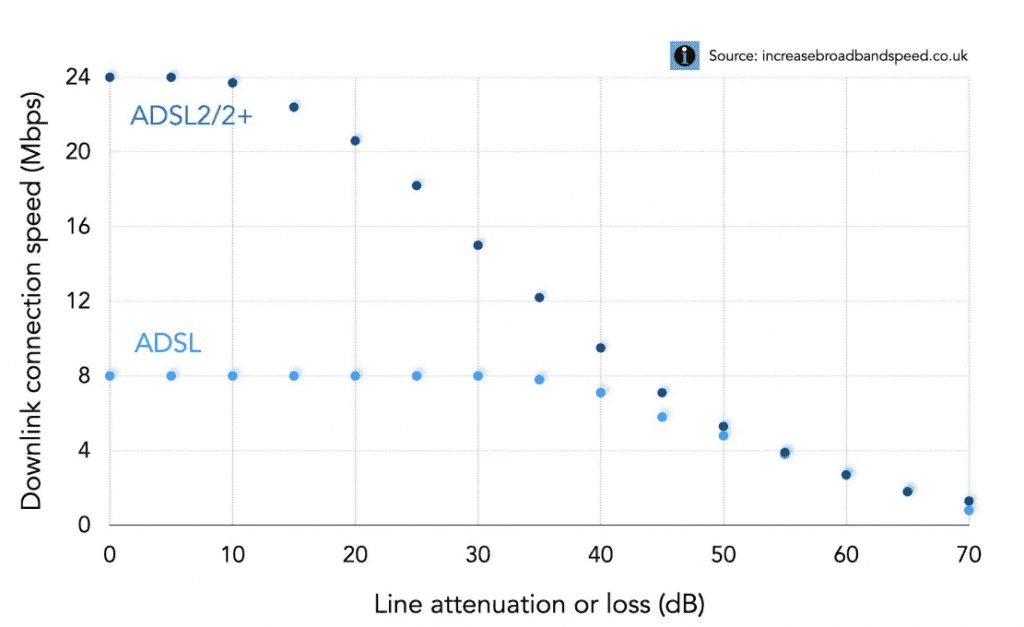

Reasons for DSL Phaseout:

DSL is a distance-based service. This means that the farther the DSL signal needs to travel, the greater the signal attenuation, resulting in slower speeds. Distance is measured from the central office of the signal source to the demarcation point (phone booth/MPOE) located at your premises. While distance is the primary determinant of DSL speed, there are other variables that can negatively affect speed.

ADSL2+:The maximum throughput (speed) for ADSL2+ is 24Mb/s download and 1.3Mb/s upload. The method of data transmission for ADSL2+ is ATM (asynchronous transfer mode) with a bandwidth overhead of approximately 15%.

VDSL2:The maximum throughput (speed) for VDSL2 is 100Mbs download and 100Mb/s upload, though it is rare to achieve these figures outside of lab conditions. VDSL2 yields better speeds than ADSL2+ at distances shorter than 3,000 feet. The method of data transmission for VDSL2 is PTM (packet transfer mode) with a bandwidth overhead of approximately 5%.

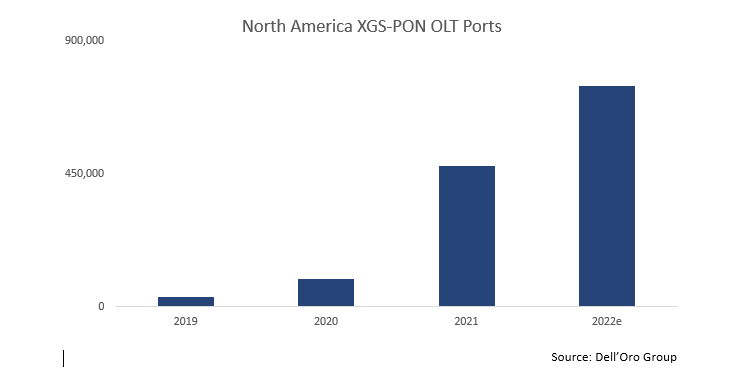

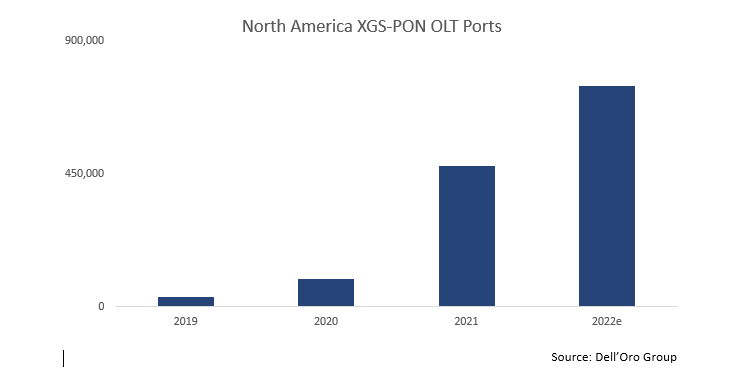

The concern regarding speeds and long-term competitiveness has led to another unique development in the North American market: The meteoric rise of XGS-PON as the primary technology used in new FTTH network buildouts. Between 2019 and 2022, XGS-PON OLT port shipments have increased 2231%, jumping from 32k in 2019 to an expected 748k in 2022. It’s likely the numbers in 2022 would be even higher were it not for the lingering supply chain issues that have resulted in considerable vendor backlogs.

While tier 1 operators such as AT&T and Frontier Communications constitute the bulk of these shipments, it’s important to note that XGS-PON is being deployed by operators of all shapes and sizes, including electric co-ops, rural operators and tier 3 telcos and cable operators. In fact, after many informal conversations with these smaller, community-focused operators, it’s difficult to find one that hasn’t already deployed some XGS-PON or is in the process of building out new fiber networks that will rely on XGS-PON from the outset.

Obviously, service providers are focused on maximizing their investments and ensuring the long-term success of their expansive—and expensive—fiber buildouts. So, it’s no surprise that XGS-PON has quickly become the technology of choice for the vast majority of North American fiber providers. In fact, we have already reached the point where XGS-PON OLT port shipments are surpassing GPON OLT port shipments. That occurred back in 3Q21 and has not changed since.

The latest data from BBT shows that the XGS-PON market continued to gain momentum in the first quarter of 2021, with OLT port shipments up 68 percent sequentially and nearly 400 percent year-over-year. XG-PON continues to account for the largest share of 10G PON, and demand in China continues to remain strong as operators upgrade their networks. Overall, 10G PON(including all types of 10G PON) grew 23 percent sequentially and nearly 76 percent year-over-year. global 10G PON OLT reached 1.173 million in the first quarter of 2021.

ONT units are a slightly different story, with XGS-PON unit shipments still lagging behind GPON units on a quarterly basis. This is due largely to the embedded base of GPON networks, as well as to supply chain constraints that have limited the availability of new, cost-reduced XGS units.

Service providers clearly believe that the multi-gig symmetric services XGS-PON can deliver are now table stakes for them. In many cases, symmetric 1Gbps services are considered the lowest service tier, with symmetric 2Gbps and 5Gbps quickly becoming the mid- and high-level service tiers. Already, Bell Canada is offering a symmetric 8Gbps service tier, with Google Fiber planning to add both a 5Gbps and 8Gbps tier in 2023. Many more will follow, as the great fiber expansion in North America transitions to the great speed war.