Address

Floor 3, Building B, Honghua Science And Technology Innovation Park,

Longhua District, Shenzhen

Work Hours

Monday to Friday: 9AM - 9PM

Weekend: 10AM - 6PM

Address

Floor 3, Building B, Honghua Science And Technology Innovation Park,

Longhua District, Shenzhen

Work Hours

Monday to Friday: 9AM - 9PM

Weekend: 10AM - 6PM

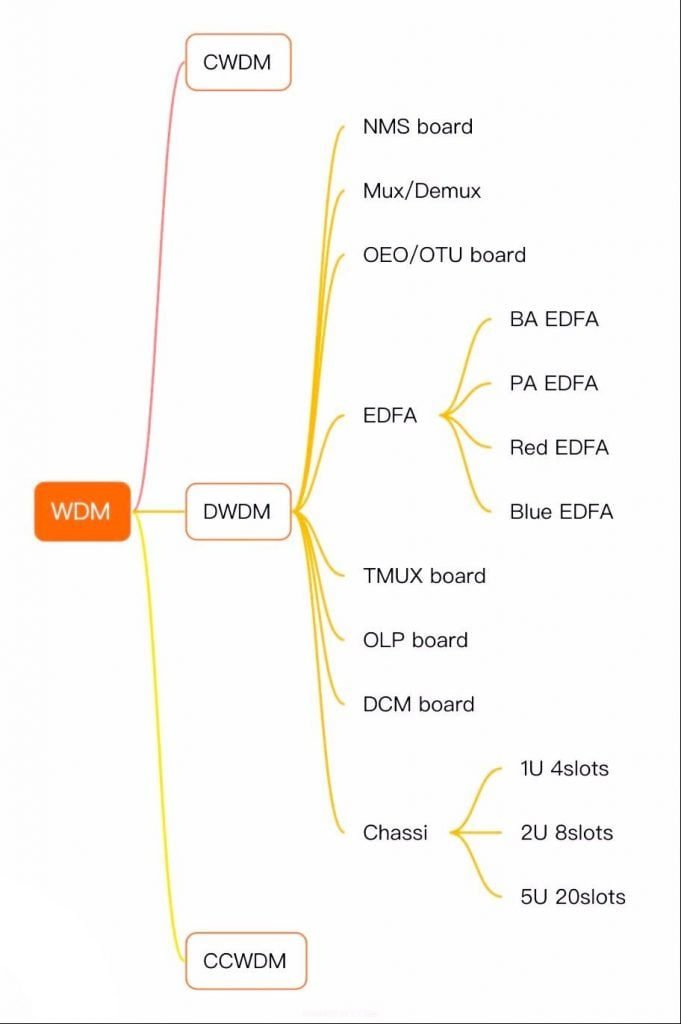

Dense wavelength-division multiplexing (DWDM) is an optical fiber multiplexing technology that is used to increase the bandwidth of existing fiber networks. It combines data signals from different sources over a single pair of optical fiber, while maintaining complete separation of the data streams.

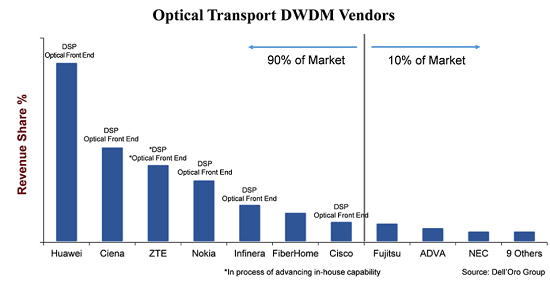

Although this is a sizeable market worth over $15 billion, there are about 20 system manufacturers actively involved in the sales and development of DWDM equipment and competing fiercely for market share. In fact, 90% of the market share is held by seven vendors, with others vying for the remaining 10%. Even among the top 7 vendors, there is a wide gap in market share, with a difference of 25 percentage points between the largest and smallest vendors.

Company size and investment appear to be key differentiators in dividing the market, with all the top vendors except for Fiberhome investing in vertical integration in line-side components. Whether the optical front-end is based on silicon photonics (SiPh) or indium phosphide (InP) does not seem to matter, although industry authorities continue to debate the two technologies. The decisive factor is that the company has developed an in-house technology that can differentiate its own products from those of its competitors and reduce product costs. In addition, vertical integration poses a barrier to new (or even old) entrants because of the considerable scale and resources (money, people, and intellectual property) required to develop these components.

As with most industries, the external force in the optical transport industry is product substitution. While product substitution has not been a real threat over the past few decades due to the inherent performance and cost advantages of DWDM technology and the system-level limitations of integrating DWDM technology into adjacent platforms, the advent of small 400ZR pluggable optics has started to shift the tide.

These new pluggable optics in the QSFP-DD form factor can transmit 400Gbps wavelengths up to 120 km, and we expect IP-over-DWDM (IPoDWDM)-a system architecture that integrates DWDM optics into an Ethernet switch or router-will raise the level of competition in the DWDM equipment space. (Top Ethernet switch and router vendors include Arista, Cisco, Juniper and Nokia).

However, 400ZR will also benefit optical DWDM providers. One reason is that not all operators will want to change their networks to IPoDWDM and will selectively use 400ZR pluggable optics on DWDM systems, thereby keeping the network architecture somewhat intact while benefiting from the lower cost of 400ZR. As a result, most manufacturers of 400ZR pluggable optics consist of companies with a long history of coherent DWDM system development, such as Ciena, Cisco and Nokia. Huawei also intends to develop the 400ZR, but it is uncertain whether U.S. restrictions on the company will delay the process.

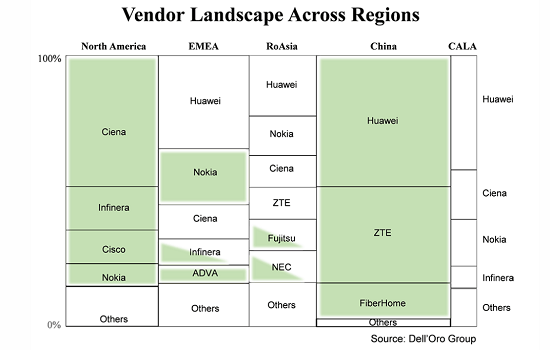

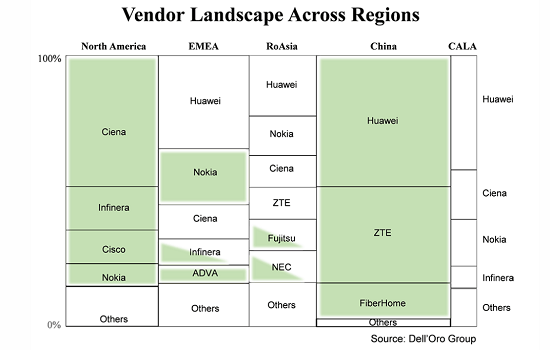

Usually, customers prefer to buy equipment from local suppliers. In the chart below, the global DWDM equipment market is divided into several major regions and the vendors that supply that region. The size of the boxes depict the share of suppliers in that region, and the green shaded boxes represent the local suppliers in that region. In North America and China, two regions with a large number of local suppliers, a large number of DWDM orders are going to their local companies. As for “Others”, analysts did not shade the box due to its highly mixed nature, but in North America and China, most of the “Others” are actually made up of local companies as well.

The non-shaded box may be a concern. The reason for this is that these service providers who choose to supply from non-local suppliers are increasingly concerned about equipment supply following the restrictions imposed by the US on ZTE (2018) and Huawei (recently). They are looking to reduce their risk by reducing their dependence on any one vendor and by considering additional local suppliers. From this perspective, this benefits smaller companies such as Tejas in India, Padtec in CALA (Caribbean and Latin America), and PacketLight in EMEA (Europe, Middle East and Africa). However, larger service providers will likely continue to buy most of their equipment from large DWDM manufacturers with the scale and technology to support the company’s future growth.

The best word for the state of the optical wavelength division multiplexing (WDM) equipment industry this year is perhaps “dynamic”. Because the development of previous years to compare, this year, the optical communications industry may reshape the industry’s new momentum.

Refer: What is dense wavelength-division multiplexing (DWDM) and how does it scale bandwidth?