Address

Floor 3, Building B, Honghua Science And Technology Innovation Park,

Longhua District, Shenzhen

Work Hours

Monday to Friday: 9AM - 9PM

Weekend: 10AM - 6PM

Address

Floor 3, Building B, Honghua Science And Technology Innovation Park,

Longhua District, Shenzhen

Work Hours

Monday to Friday: 9AM - 9PM

Weekend: 10AM - 6PM

In 2021, people’s demand for traffic drives service providers to upgrade their networks, 5G user growth, traffic share is expected to further increase, cloud data center capital expenditures are expected to remain up, and 400G optical module sales gradually increase. 2021 first half, foreign optical communication M&A integration frequently, giants target future track and core technology, foreign communication upstream into the oligopoly pattern. Tight chip supply may affect the construction progress of fiber optic network and 5G network. These bring a lot of certainty and uncertainty to the optical communication market.

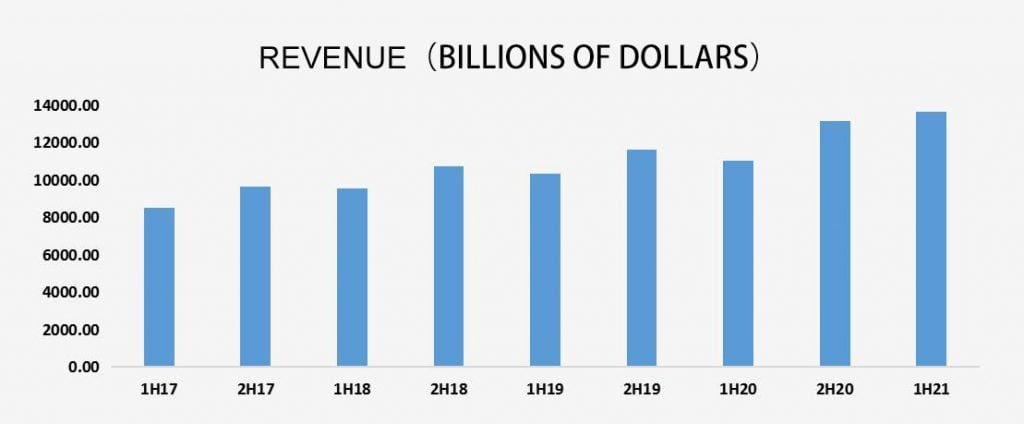

By the end of August 2021, listed optical communication companies have announced their performance reports for the first half of 2021. According to ICC statistical analysis, listed optical communication companies are moving in a generally positive direction. 2021 first half, ICC statistics of more than 100 domestic and foreign listed companies, the overall revenue of the communications industry is $ 136,3138 million, 2020 first half revenue of $ 110,275,151 million, an increase of 23.6%; 2021 first half gross margin of 52.97%, net profit margin was 18.01%. Gross margin change is flat, net margin has a growing trend.

All segments achieved year-over-year growth in the first half of 2021, except for equipment manufacturers, which saw revenue decline in the first half of 2021, down 8.17%. Component material vendors saw the largest growth, up 78.79% year-over-year. The next largest segment was Internet content operators, whose revenue grew 37.57% year-over-year. Telecom operators’ revenue grew by 12.14%, test equipment vendors’ revenue grew by 19.87%, fiber optic cable vendors’ revenue grew by 15.56%, and chip vendors’ revenue grew by 17.91%. Active device revenue increased by 20.43% and passive device revenue increased by 31.04%.

By segment, spending on cloud services and ICP (Internet Content Providers) continued to grow rapidly in the first half of 2021. Traffic growth drives the IDC industry, Internet content providers revenue growth, while accelerating investment in the construction of data centers. the ICC statistics of Internet content providers in the first half of 2021 revenue totaled $ 802,408 million, compared with 583,283 million in the first half of 2020, an increase of 37.57%. Internet content providers gross margin for the first half of the year was 50.36%, down 0.61 percentage points from the same period last year; net margin was 21.82%, up 5.56 percentage points from the same period last year.

In the first half of 2021, ICC statistics of telecommunications operators revenue totaled $ 366.635 billion, up 12.14% compared to $ 326.933 billion in the same period last year; telecommunications operators gross margin of 66.11%, net margin of 13.53%, an increase of 2.88 percentage points. According to GSA, 176 commercial 5G networks were launched worldwide by mid-August 2021. 461 operators in 137 countries/regions are investing in 5G. telecom operators are actively upgrading or deploying networks to meet customer demand.

In the first half of 2021, the total revenue of system equipment vendors counted by ICC was US$113.739 billion, down 8.17% year-on-year. The overall revenue decline of equipment vendors was mainly affected by the declining performance of Huawei, whose revenue decreased by 133.6 billion yuan year-on-year in the first half of 2021, a decline of nearly 30%. Gross margin was 43.93%, up 1.74 percentage points year-on-year; net margin was 11.44%, up 1.55 percentage points. Meanwhile, component shortages put pressure on small equipment manufacturers in the first half of the year due to increased lead times caused by global semiconductor production constraints. ADVA and Infinera quantified the impact of the shortages on sales (10% and 6% of revenue, respectively), but larger equipment vendors reported that the shortages had little impact on company sales. Equipment vendors do not expect these issues to be resolved until 2022.

In the first half of 2021, the ICC statistics of the test equipment vendors as a whole performed better. Their revenue totaled $4.799 billion, compared with $4.003 billion a year ago, an increase of 19.87%; gross margin was 53.73%; net margin was 13.79%, an increase of 3.7%.

Component vendors, the statistics of passive device vendors in the first half of 2021 total revenue of $4.204 billion, compared to $3.208 billion in the same period last year, an increase of 31.04%, the gross margin of 34.77% in the first half of 2021, compared to 31.86% in the same period last year, an increase of 2.92%; net margin of 10.98%, an increase of 4.62 percentage points. The total revenue of the active device vendors counted in the first half of 2021 was $5.213 billion, compared with $4.329 billion in the same period last year, an increase of 20.43%; gross margin was 27.29%; net margin was 11.39%, an increase of 4.28%. Component revenue growth is mainly in the first half of 2020 most optical device vendors due to capacity constraints and supply chain tensions and other external environment, revenue is at a lower point, so the first half of 2021 increased more significantly. According to the analysis report, the global optical module market is expected to remain growing, the demand for 400G optical modules continues to be released, data center cloud spending is still growing, and the demand for optical devices remains strong.

For component material vendors, the total revenue of component material vendors counted by ICC in the first half of 2021 was USD 574 million, an increase of 78.79% compared to USD 322 million in the same period last year. The growth of component material vendors’ performance was mainly attributed to Sanhuan Group, whose 2021 revenue grew 74% to $2.8 billion and net profit increased 94%. Gross margin was 51.2% and net margin was 34.19%. Compared with 31.73% in the same period last year, an increase of 2.46 percentage points.

Fiber optic cable vendors, the fiber optic cable manufacturers counted in the first half of 2021 revenue totaled $ 40.118 billion, up 15.56% from $ 34.716 billion in the same period last year; gross margin was 19.32%. Net margin was 2.33%. fiber optic cable demand rebounded in the first half of 2021 from the earlier lower point, but product decline put greater pressure on the industry, fiber optic cable in 2020 in the historically low range of sales prices, fiber optic cable business performance under pressure, so the first half of 2021 fiber optic cable business revenue grew significantly.

In COVID-19 and high-tech competition between China and the United States, the global chip shortage and traditional supply chain disruptions, the semiconductor industry began to readjust. 2021 first half chip industry consolidation and acquisition frequently. 2021 first half, the total revenue of the chip vendors counted 20.761 billion U.S. dollars, an increase of 17.91%, gross margin of 55.54%; net margin of 22.43% In the first half of 2021, chip prices rose and chip shortages made chip companies’ net profit and revenue grow rapidly.